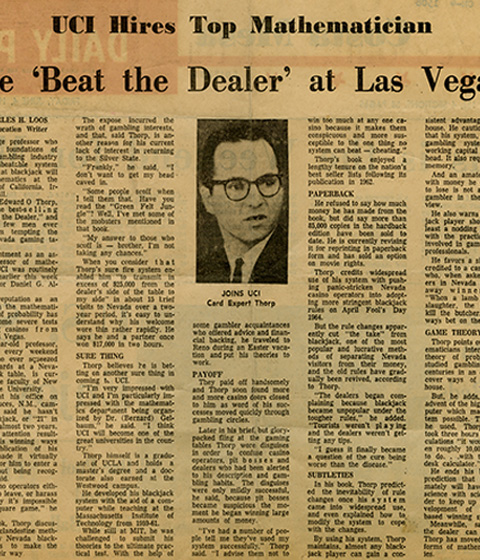

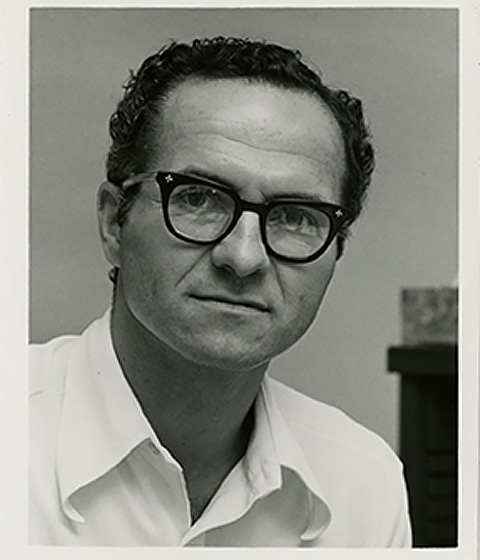

Charles H. Loos. Daily Pilot. June 4, 1965. Page 2. Articles from UC Irvine Libraries Special Collections and Archives, Edward O. Thorp Papers.

UC Irvine Hires Top Mathematician: He "Beat the Dealer" at Las Vegas

Edward O. Thorp at the Blackboard, 1967

Edward O. Thorp was hired in 1965 as an associate professor by the University of California, Irvine as part of the newly formed Mathematics Department. He remained with the Mathematics Department until 1976. A colleague of his characterized Thorp’s work with the department, “In an era when society is demanding in the return for support, mathematics demonstrate its usefulness, Thorp is by far the most visible and active applied mathematician on our faculty.”

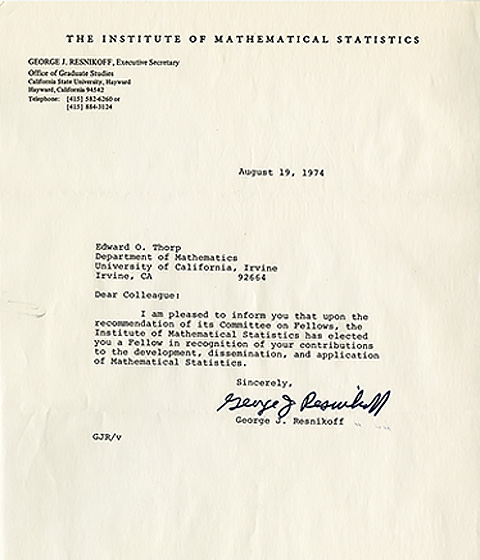

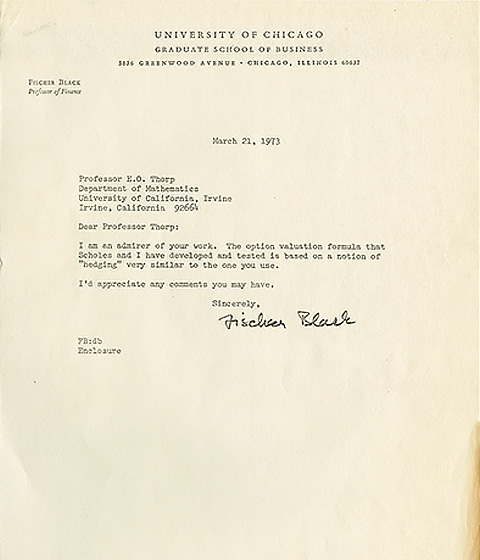

Unpublished letter, UC Irvine Special Collections and Archives. Edward O. Thorp Papers.

Mathematics Faculty at UC Irvine, 1967

Edward O. Thorp taught courses in probability and functional analysis. He also worked with and researched mathematical economics, game theory and applications, and statistical metric spaces. He said when he first arrived, “I’m very impressed with UCI and I’m particularly impressed with the mathematics department being organized by Dr. Gelbaum. I think UC Irvine will become one of the great universities in the country.”

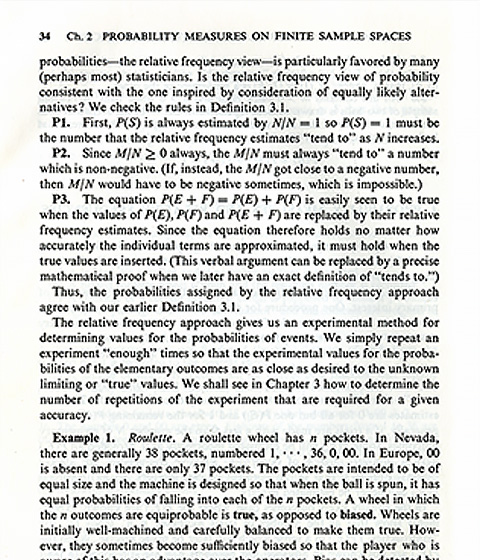

Elementary Probability

Edward O. Thorp wrote a textbook based on the syllabus he developed teaching classes at UC Irvine. Thorp said in an interview, “Most people don’t have an intuition for statistics and chance. They think if red comes up ten times in a row... the odds are better that it will be black the next time. And that’s not true. Chance phenomena are a hard concept to most people. You have to train your mind to understand them.” In this example (Page 34) he shows how a roulette wheel can be used to examine and create a “finite probability space that can be realized in practice.”

Draft speech, UC Irvine Special Collections and Archives. Edward O. Thorp Papers.

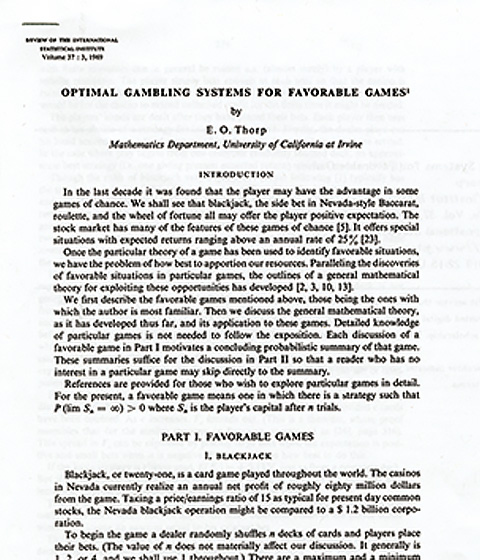

Edward O. Thorp. Revue de l’Institut International de Statistique/Review of the International Statistical Institute, Vol. 37, No. 3, 1969. Pages 273–293.

“Optimal Gambling Systems for Favorable Games”

Professor Thorp revisited his experiments with probability and gaming into a single overall synthesis. A reviewer at the time said of it, “It has the virtue of its originality and is distinguished by its application to completely realistic situations (versus conventional idealizations). Connects modern developments in probability theory with the information sciences, in particular by showing how computers can be used, not only to investigate experimental situations but as a guide to obtaining results in pure and quite abstract mathematics as well.”

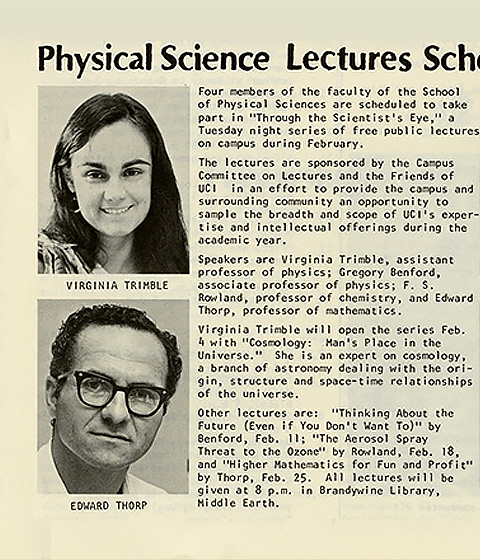

February 25, 1975. Articles from UC Irvine Libraries Special Collections and Archives, Edward O. Thorp Papers.

“Higher Mathematics for Fun and Profit,” Lecture, 1975

UC Irvine items January 6–12, 1975. Articles from UC Irvine Libraries Special Collections and Archives, Edward O. Thorp Papers.

“Physical Science Lectures Scheduled”

Photographs of Edward O. Thorp

Problems in finance and developing mathematical models of stock trading were another strong interest. He enjoyed sharing his knowledge with the public and his colleagues regarding how investments can be made using computer developed models. In 1977, Edward O. Thorp joined the School of Business as a Professor of Mathematics and Finance at UC Irvine. He remained in this position until he left UC Irvine in 1982.

Extensions of the Black-Scholes Option Model

Black–Scholes options pricing model is used to determine the fair price or theoretical value for a call or a put option based on six variables such as volatility, type of option, underlying stock price, time, strike price, and risk-free rate. The Black-Scholes pricing model is important because anyone can use it to assess the value of an option.

Edward O. Thorp worked on his own independent variation of this idea starting in 1968. “I speculated that in a risk neutral world I can set both opposing options (gain or loss) equal to a riskless rate corresponding to the time until expiration (which, as it happens, gives the future Black-Scholes formula). I didn’t see how to prove the formula but I decided to go ahead and use it to invest, because there was in 1967-68 an abundance of vastly overpriced (in the sense of Beat the Market) OTC options. Amazingly, I ended up breaking even overall, on about $100,000 worth of about 20 different options sold short at various times from late ’67 through ’68. The formula has proven itself in action. It was an intuitive derivation that was kept secret for the benefit of my investors and myself.”

Thorp’s notes. UC Irvine Libraries Special Collections and Archives, Edward O. Thorp Papers.

The formula developed by three economists — Fischer Black, Myron Scholes, and Robert Merton — is perhaps the world’s most well-known options pricing model. It was introduced in their 1973 paper, “The Pricing of Options and Corporate Liabilities,” published in the Journal of Political Economy. Black passed away two years before Scholes and Merton received the 1997 Nobel Prize in Economics for their work in finding a new method to determine the value of derivatives.